If you have already created grooming/training services or nursery/hotel stays that they are not already invoiced, you could delete these services directly. Select & click the service to view all the information and in the bottom of the page you could see a red color button Delete to delete that service.

If the service/stay has already been invoiced, it is not possible to delete the invoice, because the legislation does not allow to modify/eliminate invoices and in compliance with the legislation, we must guarantee the integrity, conservation, accessibility, legibility, traceability and inalterability of records.

Issued invoices cannot be deleted or modified, as tax law strictly prohibits doing so.

What can you do if you’ve made a mistake?

If you issued an invoice and, for instance, selected the wrong customer, you can’t just delete it and create a new one, nor can you edit it to change the customer. But don’t worry — there’s a proper way to fix it.

To correct it, you simply need to issue a corrective invoice (also known as a credit note). This special type of invoice is used to rectify any errors made in a regular invoice.

The credit note (or corrective invoice) cancels the original one. Credit notes can have their own numbering sequence, separate from regular invoices. You can configure the numbering format you prefer for both invoices and credit notes, and Gespet will automatically increase the numbering by one each time a new one is created, ensuring all are consecutive.

Neither invoices nor credit notes can be deleted. Once an invoice has been canceled through a credit note, that credit note cannot be deleted or undone.

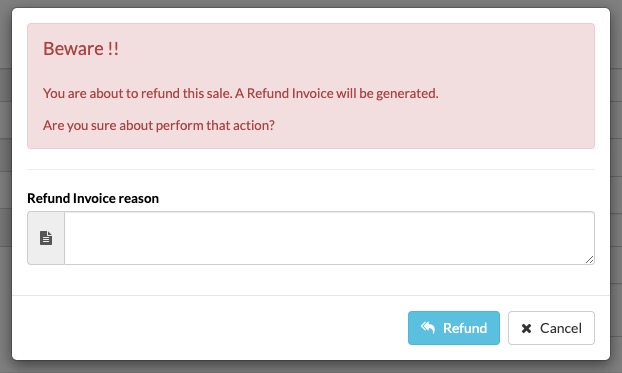

This process is irreversible. That’s why, when you click the Cancel button, the system doesn’t immediately proceed — instead, a red pop-up warning appears to confirm your action. You must confirm once again that you want to continue. In other words, there’s a double confirmation step to avoid issuing a credit note by mistake.

The correction (credit note or corrective invoice) is done in two steps:

Cancel the original invoice and generate the corrective invoice or credit note with negative amounts.

Create the new invoice, which now contains the correct information.

If the customer’s information is incorrect and you need to issue a corrective invoice to fix it, you can do it in two ways:

Option 1: If you need to correct the details before generating the corrective invoice:

First, go to the customer’s profile, update the information, and click Save.

Now you can issue the corrective invoice or credit note, which will include the new details you just updated in the customer’s profile. In the “reason for cancellation” field, if you wish, you can explain the reason — in this case, the correction of incorrect data.

When you generate the new invoice, it will include the updated information.

Option 2: If you don’t need to correct the details before generating the corrective invoice:

Generate the corrective invoice. It will contain the same customer information as the original. In the “reason for cancellation” field, if you wish, you can indicate the reason — in this case, the incorrect data.

Then go to the customer’s profile, update the necessary details, and click Save.

When you generate the new invoice, it will include the corrected details.

When a corrective invoice or credit note is issued, it automatically cancels the original invoice, payment, and the associated stay/service/sale. To register that stay/service/sale again, you’ll need to re-enter it and complete it. Once it’s finalized, you can issue the new payment/invoice.

Re-entering the stay/service/sale won’t create duplicates — the previous one was already canceled when the credit note was generated.

Let’s look at an example:

Let’s say you accidentally selected Michael Johnson as the customer, but the correct one was Michael Jackson, and you already issued the invoice. How can you fix it?

If you notice the mistake while invoicing, or later by going to View > Sales, select the invoice in question and click on it.

Click the Cancel button to issue a credit note.

You can write down the reason for the credit note — for example, “wrong customer information.”

In compliance with current legislation, this corrective invoice will include references to the original invoice being corrected (its number and date), and you can specify the reason for issuing it.

It will follow the numbering format you’ve configured.

You can print or email it if you wish.

Now you can register the stay/service/sale again, making sure you select the correct information. Once it’s completed, you can generate the payment/invoice with all the correct data.

An invoice will always show the date on which it was issued, as the issue date is legally fixed and cannot be altered.

This means it’s not legally allowed to issue an invoice with an earlier or later date, nor to change the date afterward. For example, if you create it today, it will show today’s date.

In some cases you can make invoices without taxes:

If no tax is applied in your country or activity.

If legally the invoice is tax exempt

We recommend that you check what the exceptions are in your country/activity to avoid errors or problems with billing.

In the tax-exempt invoices, it is convenient to indicate the reason why it is exempt from taxes. You can do this by including a note on the invoice. For example, in Europe, if it is an intracommunity transaction that meets the requirements to be exempt from VAT, it is best to indicate this on the invoice.

In the software, you can configure this information in the Option: Settings > Company data > Invoice text without taxes and it will appear on all the invoices you issue tax-exempt.

The tax-exempt invoice does not legally require a different numbering than the ordinary invoices, so when you issue a tax-exempt invoice, it will have the same numbering as the ordinary ones.

Recommendation: This is general advice, but the legislation varies from country to country. If you have questions about billing, applicable taxes, exceptions, etc. We recommend that you always consult a professional or the corresponding administration so that they can help you resolve all these doubts and you can make your billing correctly.

The invoice includes ALL the mandatory data: numeration, date, Tax data of

the issuer and tax data of the customer, concepts, tax rate and the option

to include additional information if you need it (eg. information from the

Merchant registry in the case of companies). Other requirements may be

necessary in your country. If someone is not included in the software,

contact us and we will include it.

Additionally, if it is a tax-exempt invoice, the explanatory text that you have configured for these cases will also appear and you also have a free text area at the bottom of the document, in case you need to add additional information. You can configure this in the Settings > Company data option.

More information about invoicesAs invoices, once issued, cannot legally be modified, the Pending Payment or Paid info and the payment date will no longer appear in the printed invoice documents.

Because if today we issue an invoice that is pending payment and in the document we indicate the status "pending payment", but within 3 days the customer makes the payment, legally we can no longer modify that invoice for change the status and put "paid" and the payment date.

In software, it hasn't changed. You can continue indicating if the invoice is paid or pending and in this way, you will know if that amount of money is pending or paid and it will be reflected in your reports and statistics

In compliance with current legislation, the software guarantees the integrity, conservation, accessibility, legibility, traceability and inalterability of the records.

And the software does NOT allow:

Make double accounting to invoice without declaring it

Do not reflect, totally or partially, the recording of transactions carried out

Record transactions other than the entries made

Alter transactions already registered in breach of applicable regulations

Additionally, we offer the user recommendations and "good practices" for managing their business.