To calculate taxes, you must take into account all income and expenses.

If you do not have software or a computerized system, it can be a complex task and it is very common to forget to include some income or expenses.

Using Gespet software, collecting the information for the payment of taxes is very simple:

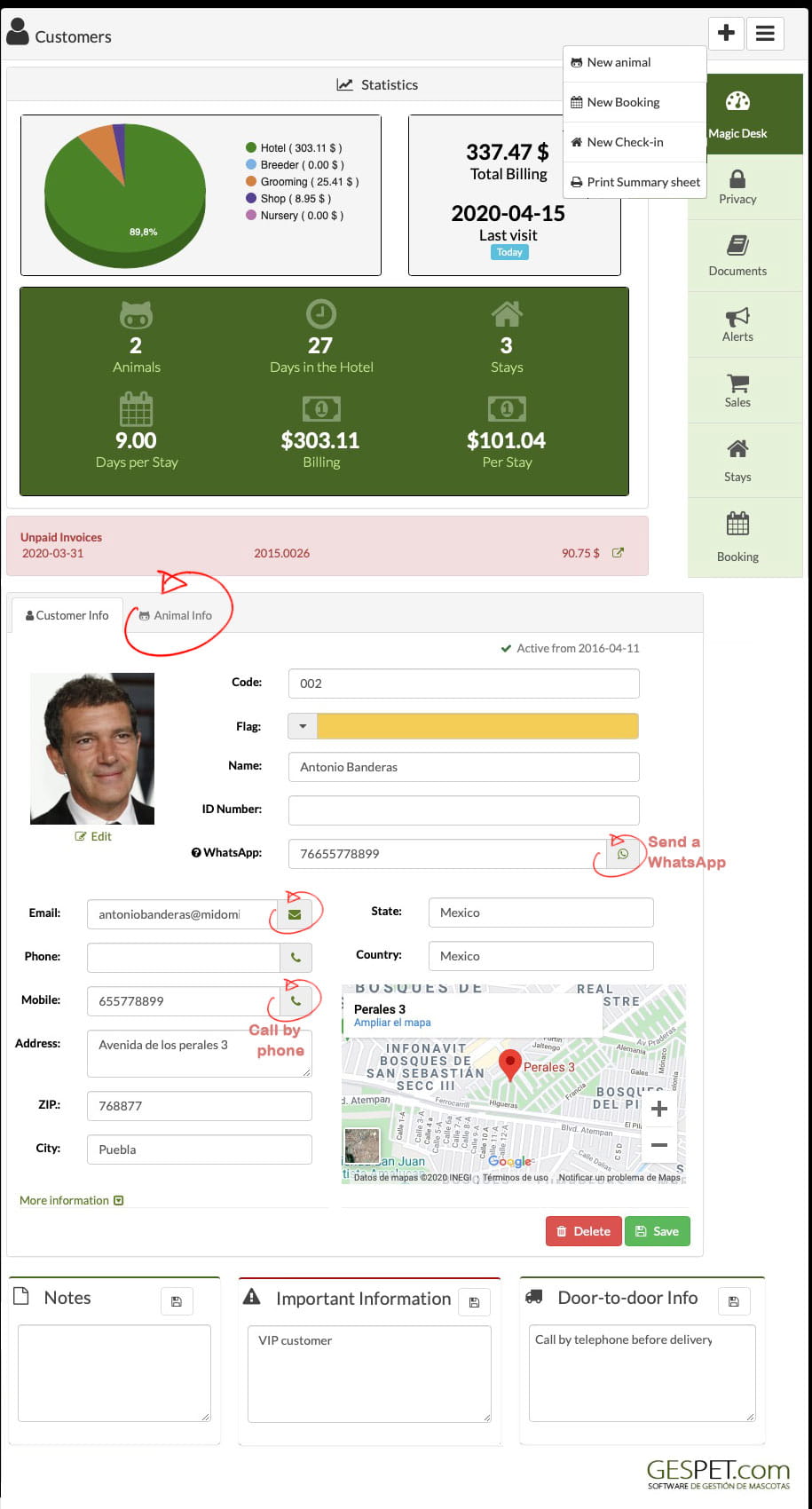

All the sales that you make from the software (hotel and daycare stays, training and grooming services, sale of animals and sale of products) are automatically recorded as income.

All the orders you make from your store are automatically recorded as expenses and you can easily record the rest of the expenses (payments, purchases from suppliers, etc.)

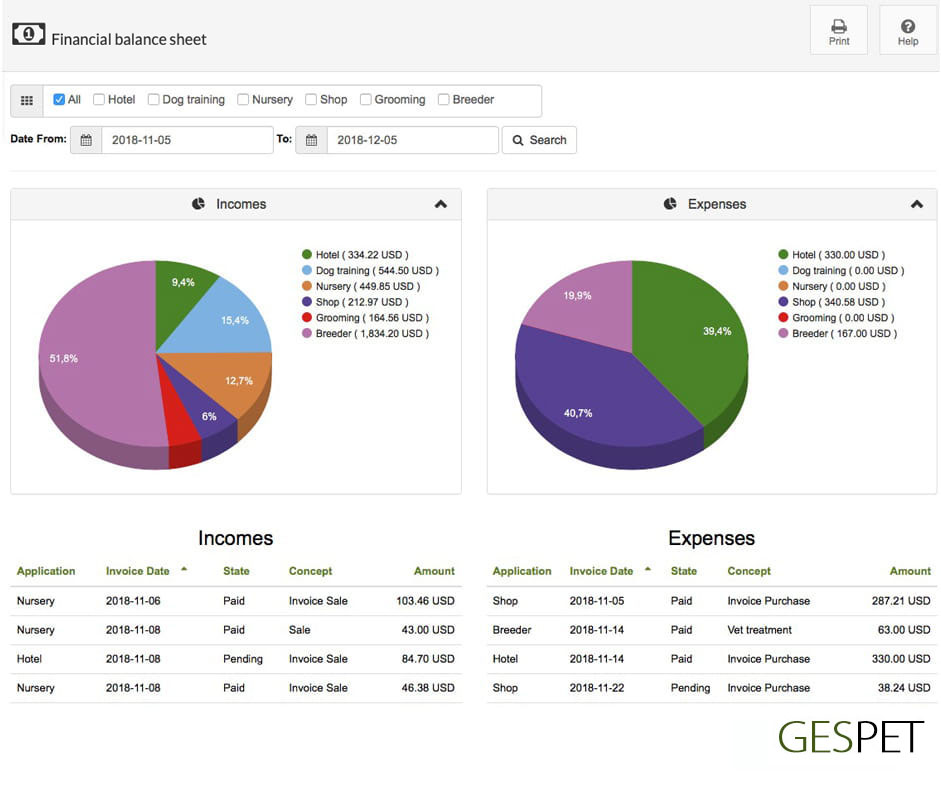

In the option Reports > Result Report > You can easily see all the income and expenses in the period of time you want.

If you have several business areas, you will see the detail of the income and expenses for each of them (hotel, grooming, breeding, ...)

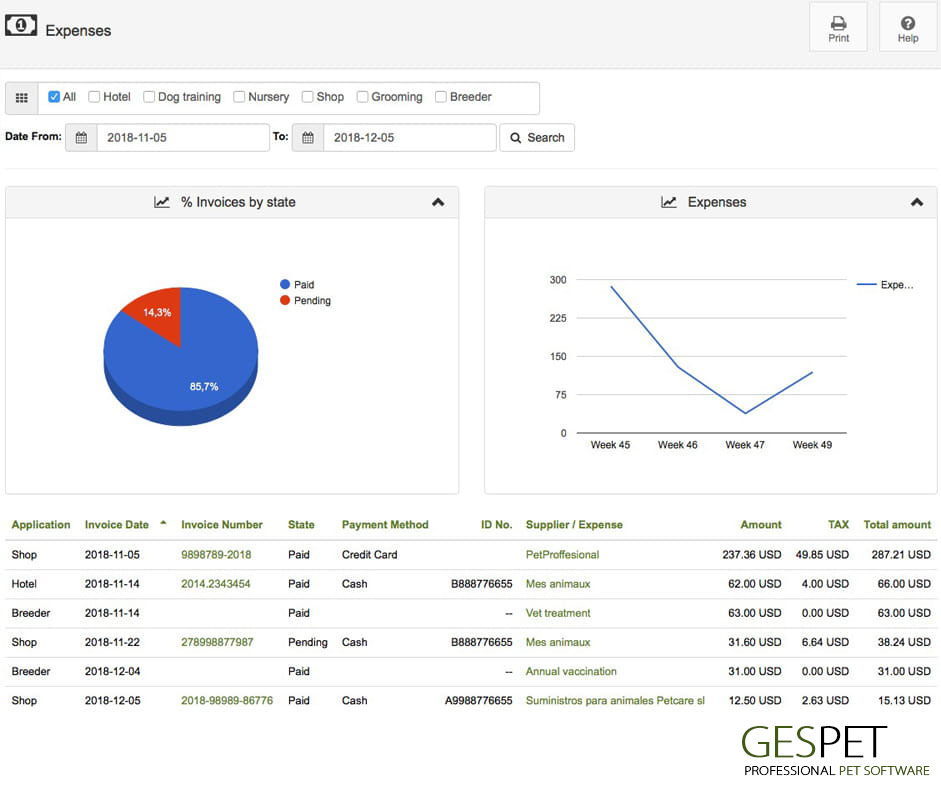

But, you have specific reports for the payment of taxes. The Billing

(Income) and Expense reports.

If, for example, you want to present the taxes corresponding to the last quarter of the year, you only have to select the range of dates (from October 1 to December 31) and all the detailed information of each of the invoices will appear (customer data / supplier, number and date of invoice and detail of amount and tax rate).