In the same way that you register your income, it is very interesting that you record all your expenses; In this way you can know the real profitability of your business.

For the presentation and payment of taxes, you must record the detailed income and expenses.

Expenses must have an associated supplier, the person who has rendered that service to you, or sold that product.

More info about the mandatory data in an invoice:

Clic hereHow can I record a purchase or expense from a foreign supplier?

As you already know, invoices can be expressed in any language and currency *. Each supplier will issue its invoices in its language and currency and is not required to "translate" or convert its invoices into the language and currency of each client.

So, in this case, the question will arise. How can I register or post an invoice with a different currency than mine?.

It's very simple, we explain how to do it.

If you need to post expense invoices in another currency, for example if your currency is the Mexican Peso and you have made a purchase or a payment to a supplier in another currency, for example in American Dollars, you will simply have to post them in Peso Mexican to change the date of payment.

Let's see it in an example.

John makes a payment of 300 Dollars to that company.

When consulting your bank/card statement, you see that the amount has been 5431 Mexican pesos.

Juan writes down or posts that invoice with a value of 5431 Mexican pesos

Just like that, John can record the expense or purchase that he has made from a foreign company or supplier.

* With some exceptions, such as invoices where VAT is charged, in which the VAT rate must appear expressed in Euros. If you have doubts about your particular case, we recommend that you always consult a professional or the corresponding administration so that they can help you resolve all these doubts and you can bill correctly.

Using Gespet is very simple and fast:

If the supplier is new, add it and Gespet will remember it for the next time. If the supplier was already registered in your database, only selected.

From the New supplier and New expense options you can add them

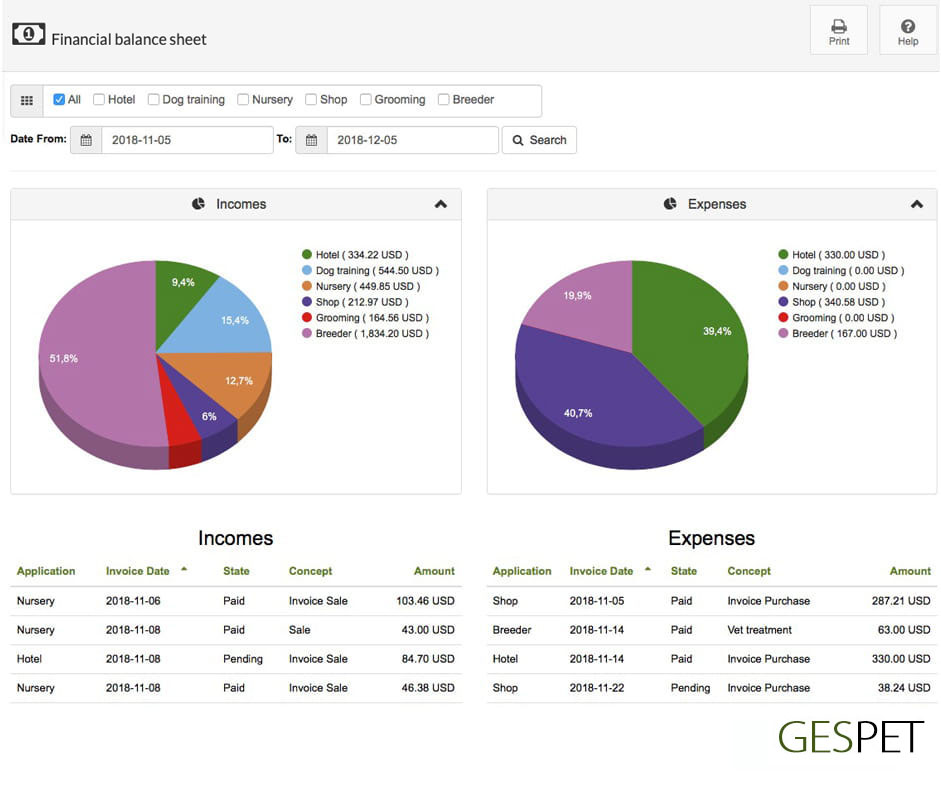

You can check the benefit of your business in real time: income and expenses. Only access the option Reports and graphics> Result.

If you have several business areas, you will see the detail of the income and expenses for each of them (hotel, pet grooming, breeding, ...)

You can enter as many expenses and purchases as you need and then you can check all the expenses made in a range of dates (for example, the last month, the first quarter of the year, etc.)

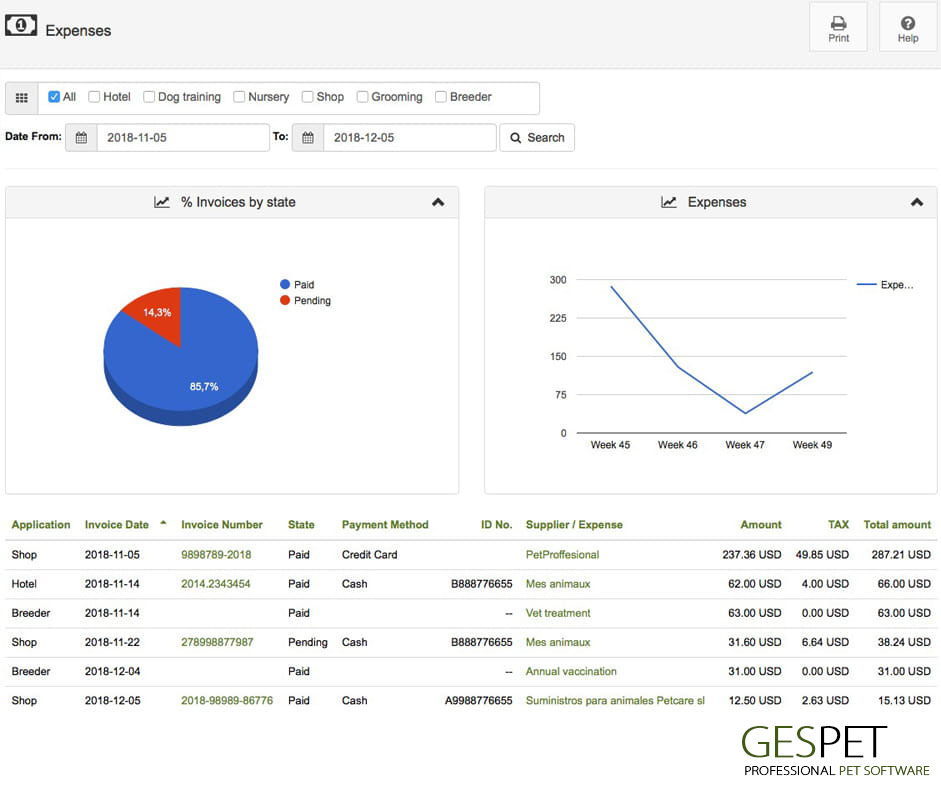

In the Reports option you will find the EXPENSES report, which includes all

the information necessary for the presentation / payment of taxes (supplier

data, date and invoice number and detail of the amounts and the tax

rate).

More info about the payment of taxes:

Clic here